Estimated Reading Time: 5 Minutes

Financial institutions offer consumers many products to help grow and manage their wealth, such as bonds, interest earning savings accounts, CDS, and more. However, with interest rates being near zero for almost a decade, many institutions are seeking new ways for their customers’ accounts to generate the lack of revenue interest earning products once brought in. To develop an effective revenue-growth strategy, financial solutions providers can benefit from better understanding their customer lifetime value and ways to improve it.

Inputs Needed for CLV

Customer lifetime value (CLV) is a calculation many companies use to project the amount of revenue their company can expect to generate from a customer, for the entire future relationship with that customer (e.g., x number of years). While CLV is a metric that is utilized across many industries, the inputs used to calculate its variables can vary from sector to sector and even per company. There are many scholarly articles proposing inputs to take into account when calculating CLV, but financial solutions providers should start by gathering the following key inputs for the CLV:

- Average balances of loans and savings on a per customer basis

- Average interest rate margin (as a percentage)

- Average income/revenue per customer generated from non-interest income sources (e.g. fees, commissions, and other sales)

- Costs of providing customer services and access (which would include transaction costs, statement costs, and potentially a provision for infrastructure costs, and so on)

Calculating CLV for Financial Solutions Providers

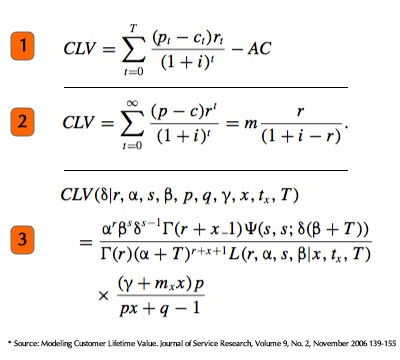

Having these figures will help institutions to calculate their marginal profit, which they will need to use in the CLV formula. The exact formula can vary from simple to relatively complex, depending on the number of variables used. The more that are included, the more accurate and insightful it will be. Two great tools to help are CLV calculator available from the Harvard Business School and this spreadsheet from CLVcalculator.com, which can calculate a more specific CLV for financial solutions providers. To illustrate the variances the formula can have, three examples of CLV calculations from academic literature are below.

When you look into the formula in the above-mentioned calculations and helpful tools, you will notice they utilize the following variables:

- New customer acquisition cost – This is how much it costs your business on average to acquire a new customer. This is the total associated marketing and sales costs your company spent during a certain time period generating new customers, divided by the total number of all the customers you brought in within that same time period.

- Marginal profit per customer – In short, this is the profit per customer. To find this, subtract the average cost of acquiring a new customer and the costs associated with providing their services, and divide it by the average customer-generated revenue.

- Discounted cash flow rate – This is the interest rate you borrow money at in your business, and it is essential to know the true value of your customer’s future cash flows. The longer you calculate your customer lifetime to be, the more important the discount rate becomes and the more inaccurate your model becomes when you ignore the rate.

- Average/expected retention rate – This is the percentage of customers that remained with the company from the previous period, based on historical averages of your company’s previous customers. To calculate retention rate, take the number of customers from last year who are still customers this year.

Improving Your Institution’s CLV

By looking at the inputs above needed to calculate an institution’s CLV, one can see the opportunities for companies to improve their overall CLV and resulting bottom line. As financial professionals know, the amount of revenue they can gain from interest on financial products can be difficult to grow, as the rates they can set while remaining competitive are partially dictated by the Federal Reserve. However, companies can focus on improving retention through the use of high-demand, value-added services that have minimal impact on operational costs.

Offering high demand value-added services to customers that they are actually looking to financial solutions providers like yours to purchase can improve two of the variables listed above: marginal profit per customer and average retention rate. If companies add services to their product portfolio that are not in-demand or customers would not prefer to purchase from a financial institution, then it will have little impact on the average revenue per customer generated from non-interest income sources. Likewise, if companies offer a high-demand product or service to their customers that have high administrative costs, then the amount it contributes to their companies overall costs of providing customer services and access can significantly reduce the impact of the increased revenue it brings. So, it is key that institutions are selective in selecting both which additional products and services to offer, and which solution providers to offer them through.

Increasing Retention & Profit without Costs & Compromise

One service that can help institutions like yours improve the aforementioned inputs and resulting marginal profit and retention rate is identity protection. Over 50% of consumers are looking to purchase identity protection in the next two years, and the majority of them reportedly will look to their trusted financial institutions to buy it. When this high-value service is offered through a partner with the global experience, powerful technology, customizable solutions, and compassionate service that will allow your company to offer protection that will improve your customers’ loyalty – without compromising on administrative costs - it can increase retention and marginal profit. As the formulas above and previous research has shown – increasing these variables can significantly increase resulting CLV and your company’s resulting bottom line.

Sign up for our email newsletter to learn about how offering Generali Global Assistance’s identity protection can help your financial institution improve your CLV by providing customers with the protection they are looking to organizations like yours to provide.

.png?width=102&height=102&name=Iris-Generali-Logo-White%20(1).png)