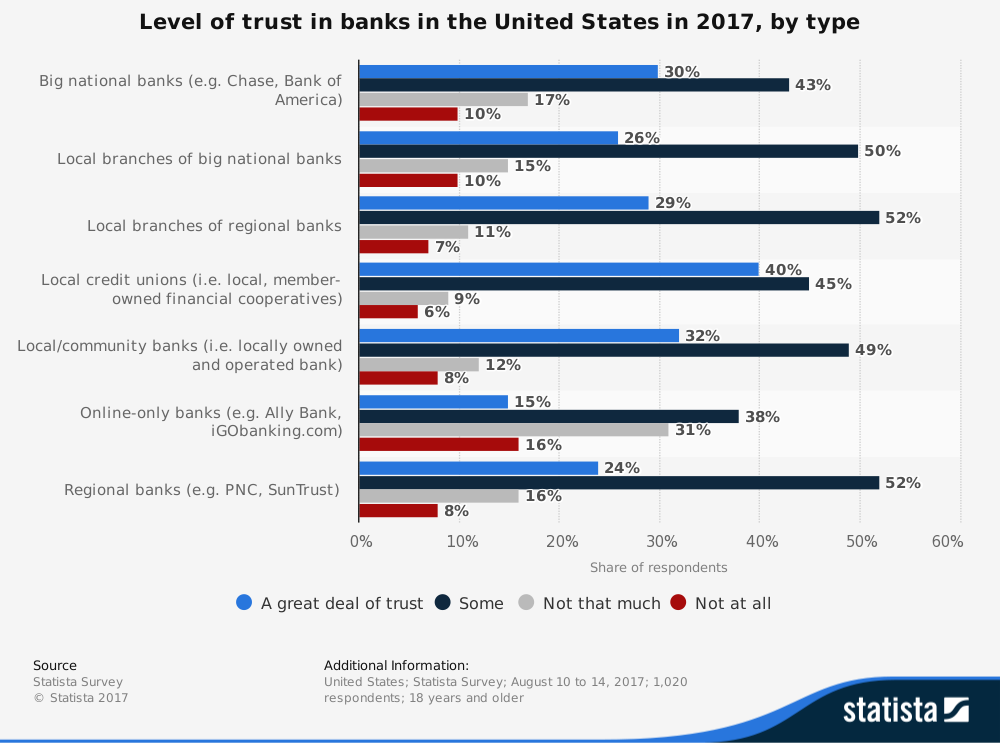

In 2016, news headlines about shady practices perpetrated by one of the most well-known financial institutions deepened some trust issues many consumers already had with the financial industry. However, consumers’ complicated relationship history with the financial sector is not all love lost. Despite some bad PR for the industry, consumer trust in financial institutions has increased in recent years; and their trust in local credit unions and banks appears to be even higher. The relationship between the financial industry and consumers appears to be on the mend, but how can institutions transform themselves from one consumers merely trust into one they love and reward with their loyalty?

Where is the Love?

It’s no secret that the majority of financial assets are held by a few large banks. So, with consumers favoring a handful of big name banks, credit unions and other smaller institutions are often left wondering how to compete against such goliaths for consumers’ affection.

To understand how to win over consumers, organizations should look to some of their most successful competitors to see what they are doing that their customers love. Among the banks rated highest by JD Power associates were some key commonalities:

The top-rated banks provide multiple, high-quality products to their customers. This in turn leads to increased satisfaction, loyalty, and retention as the number of banking products used by an individual increases. Nearly three-quarters of bank customers who use the bank for deposits, credit and investments said they “definitely will” reuse the bank, compared with just 49% of customers who use the bank solely for deposits who said the same.

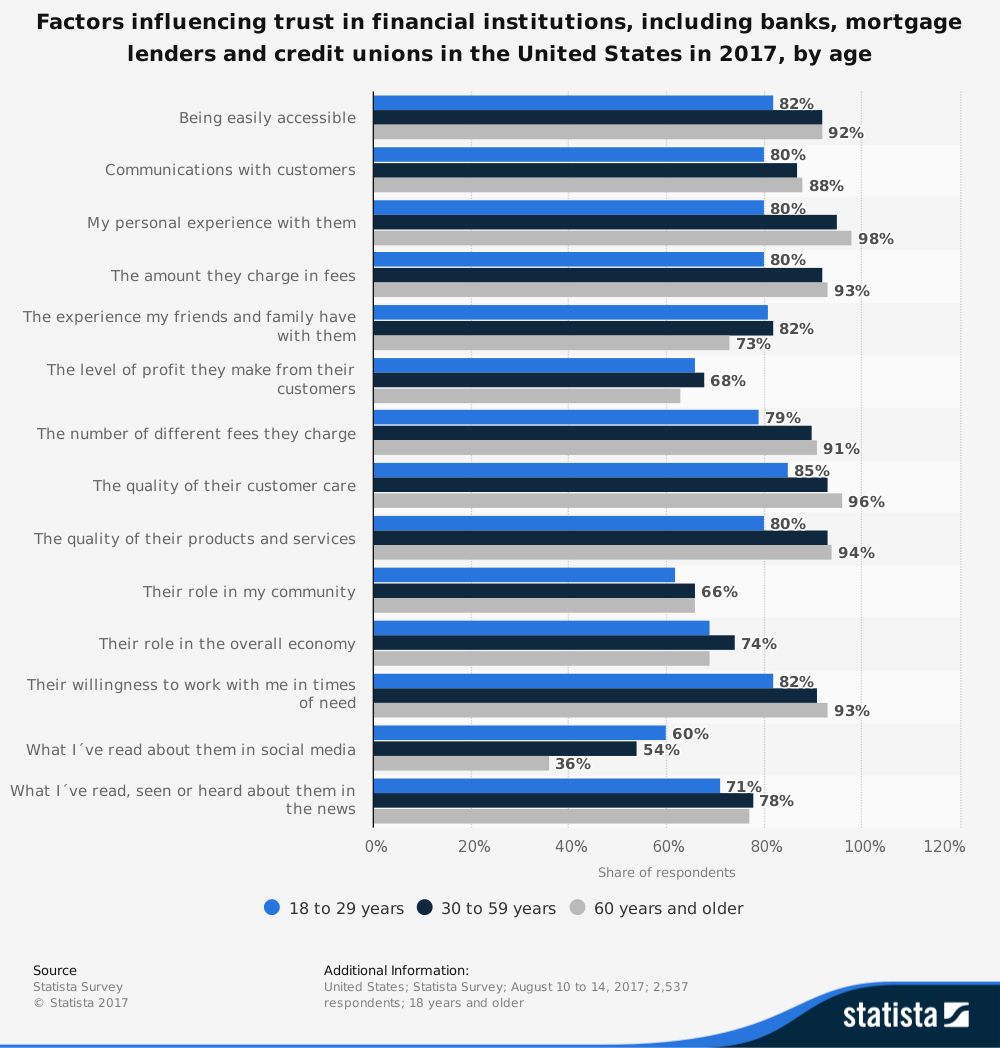

These institutions also are more likely to drive consumer trust by offering financial wellness advice and proactively sending positive communications. Among customers who indicate their bank provides financial advice that they trust, 86% said they received some proactive communication from the bank tailored to their specific needs. Another 61% said the bank advice completely met their needs and 60% said they completely understand product features and benefits.

One area these top rated banks did not all excel in was overall customer satisfaction and problem resolution. In fact, a Consumer Reports survey revealed consumers rated the customer service of products and services provided by credit unions and smaller banks higher, compared to those offered by the mega banks.

Win Hearts by Offering a Product from a Provider that’s a Perfect Match

By combining what mega banks do best with what credit unions and smaller banks do best, your financial can transform itself into one consumers will love. The latter, however, have a unique advantage in their ability to transform, as they already are exceling at the more challenging of the aforementioned aspects to improve – offering quality customer service. Moreover, their smaller size tends to make them more nimble and able to select and launch additional products and services quicker than their larger counterparts.

When your institution is considering new products and services to offer, ask yourself which ones will check all the boxes of supporting consumers’ financial wellness, proactively sending positive communications to their customers, AND providing excellent customer service? The answer is identity protection from Generali Global Assistance (GGA).

With over 50% of consumers looking to purchase identity protection in the next two years, and the majority of them looking to their trusted financial institutions to buy it, it is a product that meets a key consumer need. Moreover, GGA identity protection includes a robust library of educational identity protection resources as well as credit and identity monitoring that helps customers have more control of their financial wellness. In addition to receiving monitoring alert emails as they arise, GGA identity protection customers also receive monthly emails with their risk status and identity protection tips, which serve as both positive, proactive touchpoints and also remind them of the value of the service. Finally, our identity protection comes with award winning customer service that will serve as positive extension of your brand.

With over 80% of consumers across all age groups reporting communication, products and services, and quality of care as key factors in building trust in their bank or credit union – offering GGA identity protection will help turn your institution from just another fish in a sea of competitors, into one consumers will love. To learn more about offering identity protection without compromise, from a company consumers have trusted for over 30 years, request a demo.

.png?width=102&height=102&name=Iris-Generali-Logo-White%20(1).png)