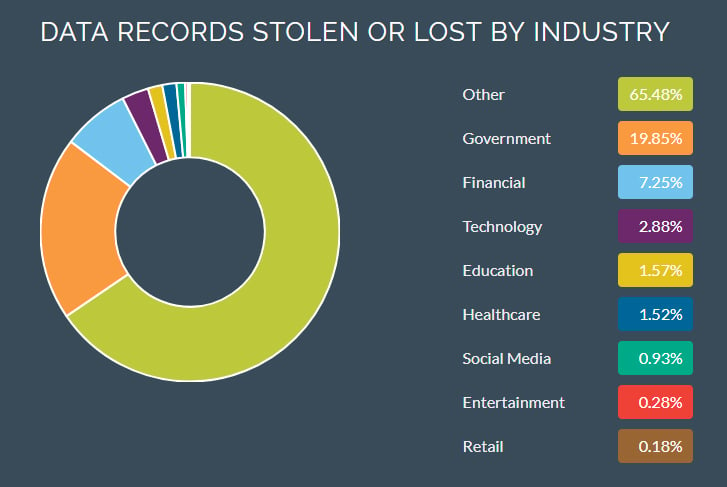

Keeping up with the latest data breach news can be dizzying. The Identity Theft Resource Center (ITRC) reports that in 2017, there were over 1,000 tracked data breaches in the U.S. – the highest year on record. Data breaches are an unfortunate “new normal”, affecting most industries and exposing millions of consumers’ data.

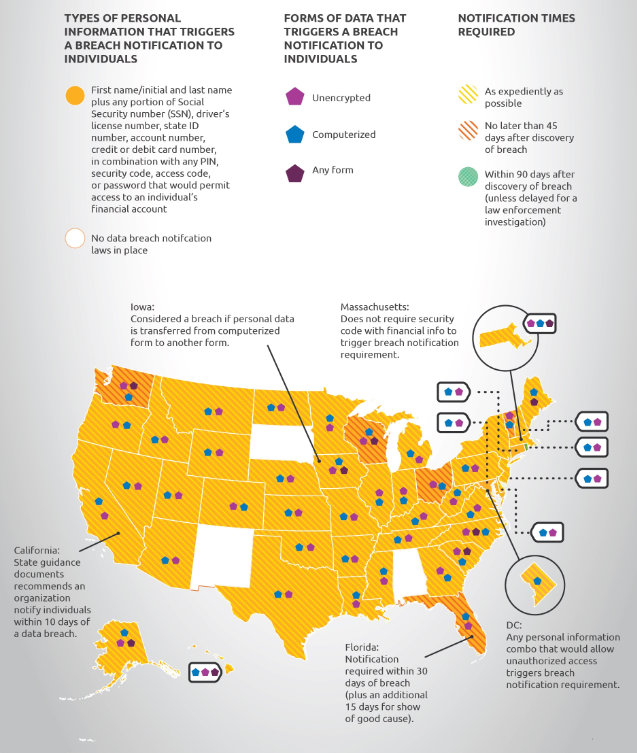

Surprisingly, there are no uniform federal data breach laws in place to which organizations must abide. This creates confusion and frustration for both companies and consumers alike, with each side seeking to define and interpret requirements and expectations. A survey conducted by the Pew Research Center reports that “91% of adults agree or strongly agree that consumers have lost control over how personal information is collected and used by companies.” The million dollar question is how to help empower consumers amidst the great absence of federal legislation.

Many businesses will offer free credit monitoring services for their affected customers – at first glance, a noble first step and token of goodwill. However, upon closer inspection, these services appear to be more of a regulatory ‘checkbox’ for businesses conducting damage control instead of providing true protection and value for the consumer.

Data breaches can leave behind a path of destruction that lasts for years, sometimes forever, for both the company and affected customers alike, and credit monitoring alone fails to effectively secure consumers’ personally identifiable information (PII) in the aftermath. Consumers who receive standalone free credit monitoring as a result of a data breach should be aware of the limited protection they are likely receiving. Only a full identity protection solution from a trusted and secure provider will offer both identity and credit monitoring and will include the option for credit tracking across all three credit bureaus – ensuring quick and seamless notification of fraudulent activity and the prevention of potentially spiraling damage.

Download our free white paper “Before the Aftermath: The Importance of Identity Protection in the Age of the Data Breach” to learn how to mitigate risk and increase customer confidence in your ability to protect their data.

.png?width=102&height=102&name=Iris-Generali-Logo-White%20(1).png)